Republic National Bank of New York, Silver Bullion Safekeeping Certificate.

Safe Keeping Receipt's, or SKR's, are bank instruments that are on the rise as collateral for alternative financing. A SKR is a financial instrument that is issued by a safe keeping facility, bank or storage house. In storage, assets or other valuables are in a safe, secured and protected area. The issuer of the SKR takes the responsibility.

PPT Custodial Bank Safe Keeping Receipt (CSKR/SKR) PowerPoint Presentation ID7402173

What Is A Safekeeping Receipt Safekeeping is where an asset owner elects to place that asset in the care of an Agent (in custody with a fiduciary), usually a Bank or a Financial Institution and receives an acknowledgement from the caretaker / fiduciary as to their " Safekeeping " of that asset.

Custodial Bank Safe Keeping Receipt (SKR) Thing You Need To Know by prominencebank Issuu

Safe-Keeping-Receipt (SKR) Procedures 1) Client forward a Letter-Of-Request (LOR) for the use of the SKR outlining the project, the requested amount and any pertinent information that explains the nature of the overall transaction. The LOR is forwarded to the Compliance Department for review.

Safe Keeping Receipt Companies Master of Documents

In a typical safekeeping agreement, the government arranges for a firm other than the party that is selling the investment to provide for the transfer and safekeeping of securities. This allows for investment transactions to be settled on a delivery-versus-payment (DVP) basis, wherein a secure delivery and payment occur simultaneously.

PPT What Is A Custodial Bank Safe Keeping Receipt (SKR)? PowerPoint Presentation ID10998282

SAFE KEEPING RECEIPT (SKR) WITH FULL BANK RESPONSIBILITY. Watch on THE HANSON GROUP OF COMPANIES HELPS YOU WITH YOUR FINANCIAL BUSINESS NOW YOU CAN DEPOSIT YOUR ASSETS AND ORDER AN SKR (SAFE KEEPING RECEIPT) WITH FULL BANK RESPONSIBILITY, WITHOUT PRE-PAYING THE BANKING FEES IN ADVANCE!!

PPT What Is A Custodial Bank Safe Keeping Receipt (SKR)? PowerPoint Presentation ID10998282

Looking forward to safe-keep your financial assets such as fur, collectible art, gold, above-ground assets, property, antiques, valuable documents, precious.

Safe Keeping Receipt Companies Master of Documents

Safe Keeping Receipt's, or SKR's, are bank instruments that are on the rise as collateral for alternative financing. An SKR is a financial instrument that is issued by a safekeeping facility, bank or storage house. In storage, assets or other valuables are in a safe, secure and protected an area.

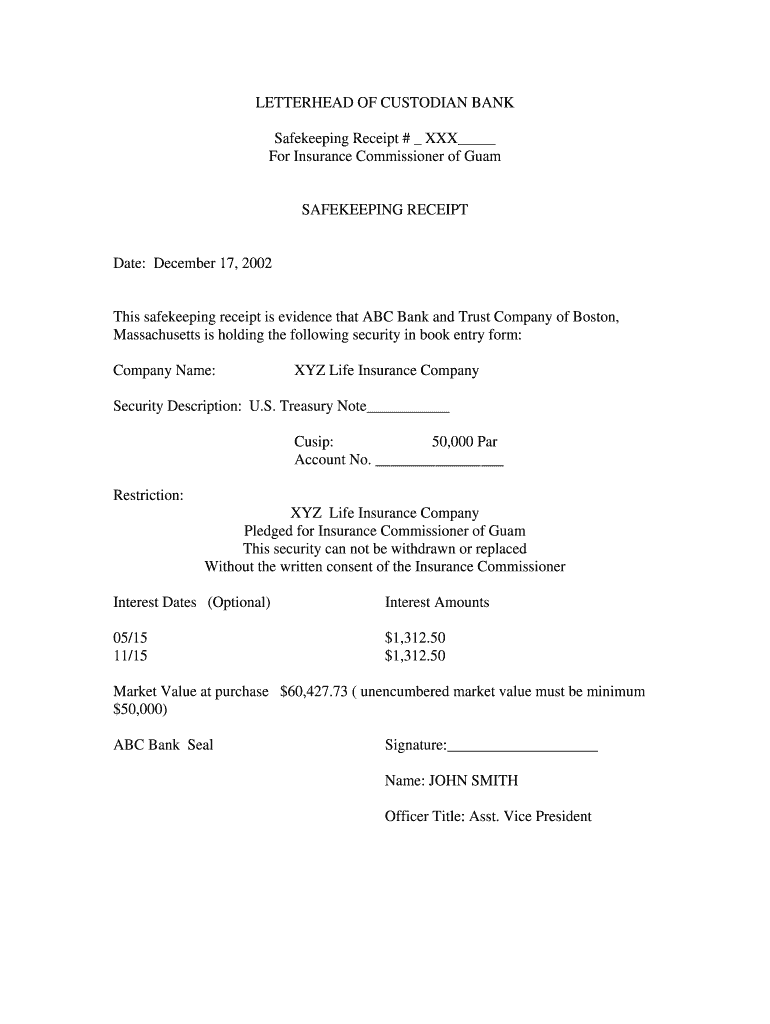

Safe Keeping Receipt Template Premium Receipt Forms

Definition of Safe Keeping Receipt: the storage of assets or other items of value in a protected area. Individuals may use self-directed methods of safekeeping or the services of a bank or brokerage firm. Financial institutions are custodians and are therefore legally responsible for the items in safekeeping.

Custodial Bank Safe Keeping Receipt (Skr) the Best Way to Protect the Assets by prominencebank

Safekeeping is where an asset owner opts to place the asset in the custody of an agent; usually a lending institution or a bank. The lender will issue a safekeeping receipt to acknowledge the care of that asset. Safekeeping receipts are a financial instrument that investors can use for asset management.

[325KG+CD+GOLD++p++2.jpg]

Safekeeping, also known as safe keep, is the storage of assets or other items of value in a protected area. Many individuals choose to place financial assets in safekeeping. To do so,.

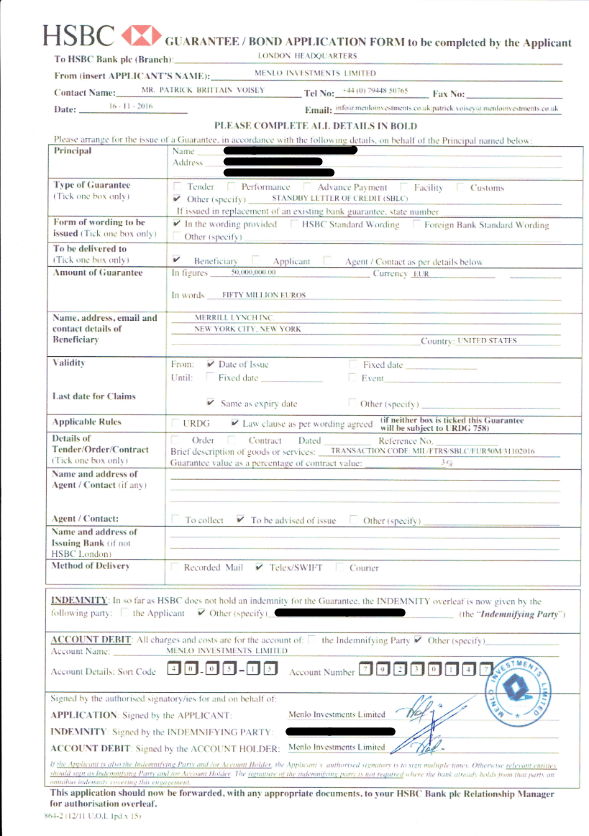

Safe Keeping Receipt Hsbc Master of Documents

A Safe Keeping Receipt, often abbreviated as SKR, is a legal document issued by a financial institution or a storage facility that acknowledges the deposit and secure storage of valuable assets.

Custodial Bank Safe Keeping Receipt (Skr) the Best Way to Protect the Assets Prominence Bank

A Safe Keeping Receipt is where an asset owner elects to place that asset in the care of an Agent (in custody with a fiduciary role), usually a Bank or a Financial Institution and receives an acknowledgement from the caretaker / fiduciary as to their " Safekeeping " of that asset.

Safe Keeping Receipt Hsbc Master of Documents

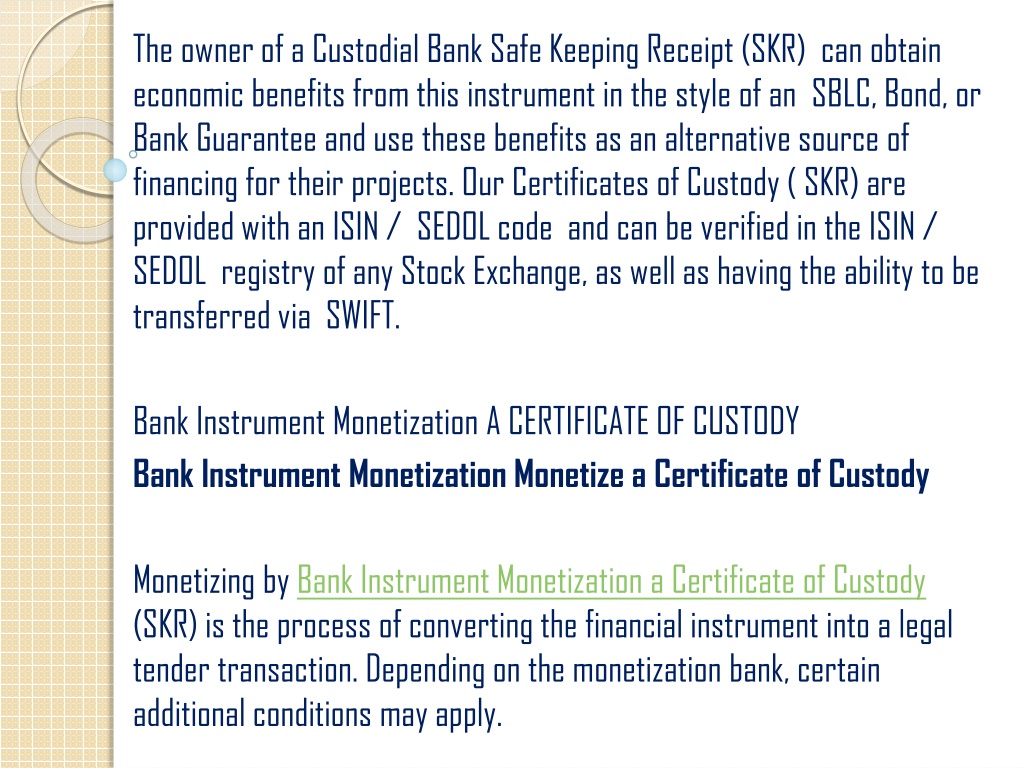

Sign an agreement. Once the terms of the monetization have been agreed upon, the client and the lender will need to sign a loan agreement outlining the terms of the loan and the rights and obligations of each party. 5. Provide the Safe Keeping Receipt. The client will need to provide the bank guarantee to the lender as collateral for the loan.

Custodial Bank Safe Keeping Receipt (SKR) With Full Bank Responsibility. YouTube

A safekeeping receipt is a document that certifies the storage of assets or valuables with a secure institution, like a bank. It's a safety net, ensuring your items are guarded and accounted for. Think of it as a vault's promise, a tangible assurance of your treasures' security. Intrigued by how this can protect your investments?

Safe Keeping Receipt Pdf 20202021 Fill and Sign Printable Template Online US Legal Forms

A safe keeping receipt, or SKR, is a document acknowledging that an agent is safekeeping your assets. You can use this safe keeping receipt as a proof of ownership. You can also use the receipt to transfer the title of your asset.

Safe Keeping Receipt Axis Bank

What Is a Safekeeping Receipt and How Do I Use It? Clark Hills | Posted on 12 July 2021 Safekeeping is when an individual places an asset that they own, for example, property titles, bonds, shares, precious metals, fur, collectible art, and more, in the care of an agent, usually a financial institution or bank.